One of the most frequently discussed aspects of investing is dividends. There are a lot of headlines touting the advantages of dividend-paying stocks: “These Dividend Stocks Can Protect You from the Next Market Drop”

“Dividend stocks are set for a comeback in [your year]” “5 Stocks with Dividends to Keep for the Next 5 Years” There are a lot of “finfluencers” on social media who often say that dividends are a magical way to build wealth and make all your dreams come true. It’s easy to assume dividends are a simple way to earn consistent income while investing. But the truth is more complex. While dividends can be attractive, they shouldn’t drive your entire investment strategy.

Let’s talk about where dividends come from, why investors like them, and how to think about total return and diversification more strategically.

What Are Dividends, Really?

Companies can return cash to shareholders through dividends. But they aren’t the only way.

When a company earns profits, it has several options:

Reinvest those earnings into the business

Buy back its own shares on the open market

Dividends can be used to pay shareholders cash. The proportion of companies paying dividends has actually dropped significantly over the past 50 years.

Why are dividends so adored by investors?

Several common motives exist:

Income: Retirees and near-retirees often like the idea of regular income hitting their accounts.

Stability: Dividend-paying stocks are sometimes seen as more stable.

Higher Returns: Some investors believe that dividends offer a way to boost total return.

Each of these has merit, but also important caveats.

The Income Illusion

Many investors think of dividend stocks as a reliable source of income, like a paycheck from their investments.

But unlike bond interest, which is contractual, dividends are discretionary. They are not obligated to continue receiving payments from businesses. During economic downturns, dividend cuts are not uncommon. In fact, during the first three quarters of 2020, total dividend payouts from U.S. companies dropped 22% compared to the same period in 2019.

If you’re depending on dividends as your income stream, you’re depending on a cash flow that can vanish when markets turn volatile.

Instead, think in terms of cash flow, which is how you can best generate the money you need, when you need it, in a flexible and tax-efficient way.

Is dividend stock stability greater?

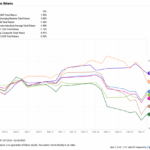

Dividend payers are often perceived as more stable, but the data tells a more nuanced story.

Yes, on average, dividend-paying stocks have shown slightly lower volatility than non-dividend payers. But that difference is modest. Both categories still experience the ups and downs typical of equity investments.

If you’re truly looking for stability, fixed income investments like bonds are designed to provide that. Dividend stocks, even if less volatile than some others, still carry the full risk profile of equities.

The Capital Trade-Off

There is a widespread misconception that dividends constitute an “extra return” in addition to capital appreciation. But in reality, when a company pays out a dividend, its stock price typically drops by the amount of the dividend.

Say a stock is worth $10 and pays a $1 dividend. The next day, the stock’s value drops to $9. You still have $10 in total: $9 in the stock and $1 in cash.

That’s why it’s important to focus on total return: the combination of price appreciation and income. Whether your return comes from a dividend or selling a portion of your investment, it’s functionally the same: money out of one pocket and into the other.

Plus, selling shares gives you more control over when you generate income and how it’s taxed. Dividend income is taxed when it’s paid, whether you need it or not. Selling a share can allow you to manage capital gains taxes more efficiently.

The Diversification Dilemma

One of the biggest downsides of a dividend-focused strategy is limited diversification.

Less than half of publicly traded U.S. companies pay dividends. That is a small portion of the market, and relying solely on dividend-paying businesses could exclude some of the most innovative or fast-growing businesses. For much of their history, dividends were never paid out by even some of the most successful businesses. Microsoft didn’t pay one until 2003, 17 years after going public.

Total Return: A Smarter Approach

Instead of chasing dividends, many investors may be better off focusing on a total return strategy that looks at the overall growth of the portfolio, regardless of where the return comes from.

This strategy provides:

More control over when and how you access cash

Potentially better tax efficiency

Broader diversification

ability to reap rewards from a broader range of stocks You can design a portfolio that emphasizes profitability, value, or size (all factors that have historically been linked to higher expected returns) without having to rely on a limited subset of dividend payers.

It All Relies on Your Plan If your goal is to generate cash flow to meet your lifestyle needs, it makes sense to step back and ask:

What are my spending needs?

What cash flow do I need from my portfolio?

How can I meet that need in the most effective and tax-efficient way?

Dividends aren’t bad, but they’re not a shortcut to financial success either.

If you’re drawn to the income they provide, take a closer look at what you actually need. You might find that a more diversified, total-return-oriented strategy gives you the flexibility, control, and long-term growth potential you’re really after.

Starting with your true goal, rather than anchoring to a specific investment type like dividend-paying stocks, helps you build a strategy that’s aligned with your life, not just the headlines.