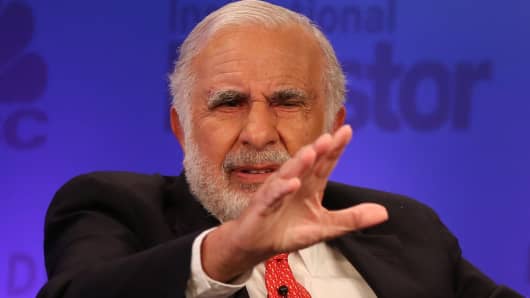

Xerox shares turned lower Tuesday, a day after activist investor Carl Icahn disclosed a new 7.1 percent stake in what he called an “undervalued” company.

Xerox stock had risen more than 7 percent in after-hours trading Monday. The stock has fallen 23 percent this year.

In trading Tuesday morning, it was down 2.7 percent.

Earlier Monday, Icahn said in a Securities and Exchange Commission filing he would discuss operational changes and strategic alternatives with Xerox management. He also mentioned possible board representation.

The stake makes Icahn the business and document services company’s second-largest shareholder, according to FactSet data cited by Dow Jones.

“We are aware that Carl Icahn has made an investment in the company. Xerox welcomes open communications with shareholders and values constructive dialogue,” Xerox said in a statement.

Ivan Feinseth, a Tigress Financial Partners LLC analyst, offered a cautious view about Icahn’s move. “I like Icahn. He has done well but I just don’t know what he can do here,” Feinseth told Reuters.