Summary

In the next three to four weeks, I plan on studying the offshore oil and gas industry.

I believe that there may be significant value plays in the industry due to the downturn. The only way to find value is to research the entire industry.

The industry may be horrible on an economic standpoint, yet there may be soggy cigars on the street labeled “The Offshore Industry”.

This report is a brief overview of offshore industry today.

Synopsis

“Practice makes perfect”

My ultimate goal for using Seeking Alpha is to become a better equity researcher. My research process up until now (90%), has been focused on individual companies. Some of the industries in which the companies I studied were very interesting to me. Unfortunately, I never dug deep into one industry.

Going forward, I plan on studying overall industries. I feel like knowing any industry better will help to produce an edge. My process will be to write a detailed report on each industry that interests me. Furthermore, I will study notable companies in each of these industries.

For the next 2-3 weeks, I will be studying the offshore oil industry. The offshore oil industry has been beaten down with many saying…

“This downturn is different from historical downturns. The industry will never be the same”

The negative pessimism in the entire offshore industry should entice deep value investors to dig further, or even just briefly look, at the beaten and ‘broken-models’ of offshore companies.

Hypothesis

The offshore oil and gas industry is one of the most ‘beat-down’ and ‘hated’industries, in today’s market. There may be significant deep value and asset plays if enough through research is conducted.

Short-History

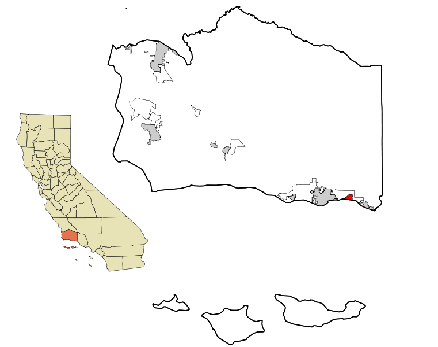

The US offshore drilling industry, began its earliest days in the Pacific Ocean, off the warm coast of California in the late 19th century. In the county of Santa Barbra, California, the small town of Summerland would become notable for its innovation of offshore drilling.

[“Source-seekingalpha”]