Engineering goods exports fell by 22.8% y-o-y, the second steepest fall after petroleum products.

Engineering goods exports fell by 22.8% y-o-y, the second steepest fall after petroleum products.

The decline in exports during the month of September has raised concerns for capital goods firms. Engineering goods exports fell by 22.8% year-on-year (y-o-y), the second steepest fall after petroleum products. Importantly, machinery exports have been declining since February.

This is likely to be mirrored in the revenue accretion of capital goods firms for the September quarter. Those with higher exposure to exports may post lower than expected revenue accretion.

Brokerages have echoed the same sentiment in their preview reports for the quarter. For instance, a Motilal Oswal Financial Services Ltd, report says Cummins India Ltd will see lower exports of the higher horse-power engines “due to declining mining activity globally following a drop in commodity prices”. A combination of factors such as deteriorating global demand, along with the plummeting crude prices, geopolitical tensions and volatile currency movements, are dragging demand for capital goods.

Demand from European and West Asian nations has taken the biggest hit. To add to this, severe competition from other emerging countries for business is weighing on India’s exports of engineering goods.

Analysts forecast even the large diversified infrastructure firm, Larsen and Toubro Ltd, may also face execution delays in West Asia. A report by Prabhudas Lilladher Pvt. Ltd says that with 25% of its order book in West Asia and media reports indicating a slowdown in Riyadh Metro, the firm could miss revenue guidance for fiscal 2016. Such developments will impact exports for capital goods manufacturers.

Delays in advances and payments on existing projects would tell on profitability on account of prolonged working capital cycles and cost overruns.

In fact, if the drop in global demand continues and the capex cycle remains subdued, it would eventually impact order inflows of Indian engineering firms. Analysts estimate that aggregate project awards in West Asia are down 51% y-o-y and are near the lowest level since 2007.

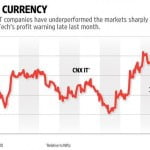

Clouds of concern on overseas order inflows and project execution have seen the BSE Capital Goods index trend lower to underperform the BSE Sensex in the last three months.

One wonders if the concerns would be offset by higher domestic demand for capital goods.

On the whole, delays in finalizing orders will translate into subdued order inflows for the September quarter.

A ray of hope is that government spends on infrastructure will gradually revive the capex cycle in the country. But for now, rural demand is a dampener.

[“source -livemint”]