On a year-on-year basis, the number of contracts awarded grew about 20%, but the total contract value was flat.

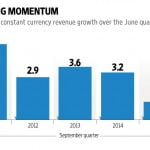

First Infosys Ltd underwhelmed investors with a weak forecast for the December and March quarters; then Tata Consultancy Services Ltd (TCS) reported weaker-than-expected earnings for the fifth consecutive quarter. Shares of the two heavyweights fell by about 6% and the CNX IT index fell by 4% last week.

If this wasn’t bad enough, latest market data from Information Services Group (ISG) show that deal activity in the information technology (IT) services space slid in the September quarter. Data from the ISG Outsourcing Index, which measures commercial outsourcing contracts with annual contract value (ACV) of $5 million or more, show 344 contracts were signed in the third quarter, down from the record 448 contracts signed in the second quarter of 2015. ACV in the third quarter came in at $5.6 billion, down 9% versus the second quarter.

John Keppel, president and partner of ISG, said: “After suffering through one of the weakest quarters in recent memory at the start of the year, then rebounding to end the half on a positive note, the market slid back in the third quarter, falling below the $6 billion ACV threshold of market health.”

On a year-on-year basis, the number of contracts awarded grew about 20%, but the total contract value was flat. In other words, the average deal size of contracts is getting smaller.

This trend means competition for large firms will get tougher as clients approach niche firms for specific needs, rather than partner with a few large firms.

ISG said contract counts and ACV for deals valued at less than $40 million both reached record highs in the first nine months. On a year-till-date basis, the number of contracts awarded grew 8%, but the total contract value has declined 11% to $16.8 billion.

Analysts at Nomura Research said in a 15 October note to clients, “We continue to believe macro indicators on demand in the sector (US PMI, private jobs, and client financials) are deteriorating and this will have a moderating impact on 2HFY16 and FY17 growth in the sector. This is apparent in the weaker guidance from Accenture for FY16 and Infosys for 2HFY16, the revenue warning from HCLT, and the moderation in the Street’s growth expectations for TCS. The preliminary ISG 3Q data further corroborate this.”

[“source -livemint”]