Crude oil prices have declined further and that is good news for lubricant makers—Castrol India Ltd and Gulf Oil Lubricants India Ltd (Golil). But the benefits of lower crude oil prices come with a lag.

Priyank Chandra, an analyst at Dolat Capital Market Pvt. Ltd, points out that prices of base oil (key raw material for lubricant makers) reflect crude oil prices with a lag of one-two months. “Further, both Castrol and Golil tend to keep 2-3 months’ base oil inventory, which means the benefits of crude oil price decline will reflect with a lag to that extent,” said Chandra.

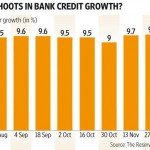

This means if crude oil prices remain stable, then investors can expect some fillip to margins for the coming two-three quarters. In fact, both companies have seen an improvement in their operating profit margin in recent quarters. The chart shows the details for the past six quarters.

One reason why Castrol’s operating margin is far higher is due to its premium pricing strategy. As the chart shows, its operating margin for the June and September quarters was 30% and 28%, respectively. But investors aren’t impressed. In the last six months, its share price has declined, albeit less than the decline in the benchmark Sensex.

Subdued volume growth is a reason. Rising competition, premium pricing, weakness in the commercial vehicle segment and a delay in economic recovery are some factors that have taken a toll on Castrol’s volumes for some time now. On the other hand, Golil has done well on the volume front. Not surprisingly, its shares have fared better.

Over FY 2010-2015, Golil has reported volume growth at a compound annual growth rate (CAGR) of 8.1%, compared with a industry CAGR of—1.6% and that of Castrol’s at—1%, through its innovative product offerings, continuous advertising and brand-building efforts, said analysts from HDFC Securities Institutional Research in a note to clients on 3 December. Analysts expect the momentum in Golil’s volume growth to continue in the future.

Nevertheless, Castrol’s better distribution reach, healthier financial ratios and strong brand name help the stock command a premium. Currently, one Castrol share trades at 31 times its estimated earnings for fiscal year 2016 (December-ending for the company).

Golil, meanwhile, trades at 23 times its estimated earnings for next fiscal year. “With faster growth and continued outperformance, Gulf Oil’s discount in valuations to Castrol could narrow going forward,” said HDFC analysts. While that augurs well, faster economic recovery and improvement in fortunes of the auto industry will go a long way in improving the operating environment for lubricant makers.

Crude oil prices have declined further and that is good news for lubricant makers—Castrol India Ltd and Gulf Oil Lubricants India Ltd (Golil). But the benefits of lower crude oil prices come with a lag.

Priyank Chandra, an analyst at Dolat Capital Market Pvt. Ltd, points out that prices of base oil (key raw material for lubricant makers) reflect crude oil prices with a lag of one-two months. “Further, both Castrol and Golil tend to keep 2-3 months’ base oil inventory, which means the benefits of crude oil price decline will reflect with a lag to that extent,” said Chandra.

This means if crude oil prices remain stable, then investors can expect some fillip to margins for the coming two-three quarters. In fact, both companies have seen an improvement in their operating profit margin in recent quarters. The chart shows the details for the past six quarters.

One reason why Castrol’s operating margin is far higher is due to its premium pricing strategy. As the chart shows, its operating margin for the June and September quarters was 30% and 28%, respectively. But investors aren’t impressed. In the last six months, its share price has declined, albeit less than the decline in the benchmark Sensex.

Subdued volume growth is a reason. Rising competition, premium pricing, weakness in the commercial vehicle segment and a delay in economic recovery are some factors that have taken a toll on Castrol’s volumes for some time now. On the other hand, Golil has done well on the volume front. Not surprisingly, its shares have fared better.

Over FY 2010-2015, Golil has reported volume growth at a compound annual growth rate (CAGR) of 8.1%, compared with a industry CAGR of—1.6% and that of Castrol’s at—1%, through its innovative product offerings, continuous advertising and brand-building efforts, said analysts from HDFC Securities Institutional Research in a note to clients on 3 December. Analysts expect the momentum in Golil’s volume growth to continue in the future.

Nevertheless, Castrol’s better distribution reach, healthier financial ratios and strong brand name help the stock command a premium. Currently, one Castrol share trades at 31 times its estimated earnings for fiscal year 2016 (December-ending for the company).

Golil, meanwhile, trades at 23 times its estimated earnings for next fiscal year. “With faster growth and continued outperformance, Gulf Oil’s discount in valuations to Castrol could narrow going forward,” said HDFC analysts. While that augurs well, faster economic recovery and improvement in fortunes of the auto industry will go a long way in improving the operating environment for lubricant makers.

[“source -livemint”]