InterGlobe Aviation, which operates India’s largest low-cost carrier (LCC) IndiGo, has come under focus for the wrong reasons – news of rift between the two largest shareholders, Rahul Bhatia (38.26 percent stake including family) and Rakesh Gangwal (36.69 percent stake including family). The allegations have become formal with one of the co-promoters writing to SEBI. The share price fell as much as 15 percent following the news.

We believe that this won’t last long as a prolonged feud is not in the best interest of the stakeholders, especially the founders with large shareholding. However, the battle has been going on for a year and solution doesn’t seem to be in sight yet. This might remain an overhang on the stock.

Having said that, the fall in stock price has made the valuation attractive. Furthermore, IndiGo is expected to benefit from the attractive dynamics of Indian aviation industry after Jet Airways’ shutdown. We advise investors to accumulate the stock during the time of weakness with an eye on the long term.

What could this tussle lead to?

The spat has been brewing for long and took a fresh turn, with one of the co-founders writing to SEBI making allegations with respect to related-party transactions, appointment of senior management, chairman and directors.

Despite operating in industry which is fraught with many challenges and more often than not resulting in huge losses to companies in the space, IndiGo has not only survived but also become profitable and the market leader in the Indian sky.

All this has come through due to the business acumen and skills of the management. If the tussle continues for long, then that would impact decision making, especially in a very dynamic environment that the airline is operating in. This would impact not only the growth for the company, but also the industry as IndiGo is the market leader with close to 50 percent domestic passenger market share.

What should investors do now?

Indian aviation sector is turning attractive after the grounding of Jet Airways, which was hit due to liquidity constraints and huge debt. The grounding has not only led to increase in the market share for IndiGo, but turned the industry dynamics favourable as competition got reduced and there has been significant improvement in yields.

The improvement in yields is due to the fact that Jet used to command 18 percent of the total industry seating capacity, which is gone leading to capacity constraint, thereby giving pricing power. Further, the impact of recent rally in crude prices would be minimal as yield would closely reflect the cost structure.

Additionally, IndiGo is getting new slots in heavily constrained airports which have been left behind by Jet Airways (40-50 percent slots in Mumbai and 20-25 percent in Delhi). This is expected to be an important trigger for growth.

Apart from the domestic opportunities, IndiGo is aggressively focusing on international route and has been getting into code-share agreement with strong international carriers.

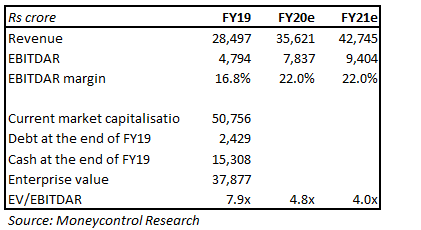

In terms of valuations, the stock price has fallen 15 percent following the news in two days and 23 percent from its 52-week high, making the valuation very attractive (4 times FY21 projected EV/ EBITDAR). In fact, it is trading at discount to its global peers. We advise investors to accumulate the stock during the period of weakness with an eye on the long term.

[“source=moneycontrol”]

[“source=moneycontrol”]