Is a ‘Enormous detonation’ around the bend?

The facts really confirm that focus risk is something you want to look out for. Nonetheless, the right sort of focus could likewise help your portfolio.

Concentrated files have been doing astoundingly well in the US. Whatever files are:

the NYSE FANG+, which involves 10 exceptionally exchanged tech monsters (counting Tesla, Meta, Apple, Amazon, Netflix, and Letter set)

the Sublime Seven, which includes seven driving tech organizations (specifically: Letters in order, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla)

the S&P 500 Top 10 and the S&P 500 Top 50, which incorporate 10 and 50 of the biggest organizations from the S&P 500 separately.

Presently, these files have performed well primarily in light of the fact that the possibilities for bigger US organizations were far superior to those for more modest organizations in the last cycle. However, bigger organizations additionally enjoy more sturdy benefits, for example, the way that they can redesign and reorient their organizations utilizing mechanical spending, which is significantly more trying for more modest firms to achieve.

How about we currently go to India. A couple of years prior, the expression ‘Large Increasing’ started seeing some prominence among Indian market watchers. However, with little and mid-cap stocks (SMIDs) having conveyed a heavenly execution from that point forward, that expression has been totally neglected.

It very well may be an ideal opportunity to treat it in a serious way once more. We accept the Biggest organizations presently offer a high edge of security versus the remainder of the universe.

India presently has a concentrated record: the Clever Top 10 Equivalent Weight file. As the name recommends, this list tracks the 10 greatest Clever stocks by market cap, and allocates them an equivalent weight. The more extensive market has beated this file in the new past; accordingly, the main 10 stocks by market cap are currently accessible at somewhat lower valuations, with less cost foam and noteworthy bring proportions back.

Consider the diagram underneath. The proportion Clever Top 10 Equivalent Weight/Clever 500 (in yellow) has been declining, which mirrors the way that different sections in the Indian securities exchange have been developing better. In the mean time, the proportion S&P Top 10/S&P 500 (in blue) has ascended throughout recent years, showing strong execution by the biggest US organizations.

What does this difference tell us? Assuming that these Indian files wind up following a direction tantamount to that of the relating US records, then the ongoing low commitment of India’s 10 biggest organizations to the more extensive market is an expected an open door. Basically, we could see a re-visitation of a time of “polarization”, during which size and quality will recapture the significance they normally have. During such a period, the Clever Top 10 Equivalent Weight record would display fantastic execution comparative with the more extensive market.

All in all, is India prepared for a ‘Major Expanding’ shift? The reality of the situation will surface eventually, yet on the off chance that you’re persuaded such a shift is reasonable sooner rather than later, you should consider adjusting your portfolio to the Clever Top 10 Equivalent Weight record.

Is it true or not that you are expanding on a sand trap?

On the off chance that you’ve just started putting resources into values over the last 18-odd months, then you most likely have a somewhat distorted perspective on the business sectors at the present time.

Permit us to make sense of. An examination of around 1900 recorded stocks for the period from Spring to December 2023 viewed that as almost 90% of those stocks wound up in the green. What was similarly noteworthy was that the vast majority of them additionally figured out how to post twofold digit or even triple-digit returns over that period1.

Subsequently, regardless of whether you’d picked irregular stocks from this colossal crate during the period being referred to, there’s a decent opportunity you’d have created a clean gain, or even beaten the Clever 500.

Thus far, 2024 seems to be a continuation of the bullish run that started in 2023, with the year-to-date returns of the Clever 500 list being around 21% starting around 21 August 20242. Such runs can without much of a stretch make you imagine that you’re a somewhat gifted stock-picker, or that such market returns are digging in for the long haul.

Yet, this is a twisted viewpoint. What’s going on here is just a live exhibition of the maxim ‘A rising tide lifts all boats’.

The brutal truth

As the more practical and grizzled financial backers among you could perceive, actually getting predictable twofold digit returns is extremely challenging. Furthermore, predictable twofold digit genuine returns (for example the compelling returns whenever expansion has been considered in) are unbelievably very uncommon.

This is valid regardless of whether we check out at the world’s most prosperous nations, over speculation skylines as long as 140+ years!

Source: Gail Dudack, Sungard Institutional Financier, Worldwide Monetary Information; DSP. Information as of July 2024. The profits are on a schedule year premise. Red means feeble cycle, blue areas of strength for means.

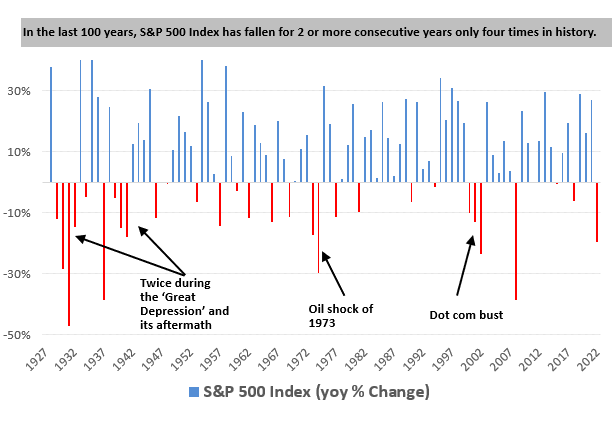

Think about the S&P 500. As the diagram above shows, times of twofold digit genuine returns were interspersed by extensive stretches of poor or even regrettable development.

Presently, the facts really confirm that financial backers have fostered an entire set-up of ways to deal with tackle this test, like Purchase and Hold, Tastes, and key resource designation. Yet, it’s essential to perceive that such methodologies are basically endeavors to explore the hidden flightiness of the market, and don’t really dispense with that eccentricism.

So assuming the stocks you’re putting resources into are of low quality regardless, the main thing such methodologies will give you is the deception of control.

Something finance essayist James Award once said is very important in such manner:

“I’m more scared of cures than illnesses.”

So what can really be done?

Ensure your portfolio is based on a strong groundwork, instead of a sand trap.

We have no control over the period over which our effective financial planning lives unfurl, yet we truly do have the ability to pick where we contribute. Also, that is what’s basic to augmenting the chances of outcome of any money management technique.

In the event that you choose to put resources into an in a general sense unfortunate stock, it doesn’t make any difference whether you purchase and hold it or make a Taste around it: your drawn out returns will endure.

Be that as it may, pick a sound business whose stock isn’t exaggerated, and you’re a lot likelier to do well paying little mind to how you put resources into it.

This is a straightforward end, however it’s vital to help yourself to remember this reality at whatever point market commotion takes steps to overwhelm the essentials.