A big a part of Procter and Gamble’s India commercial enterprise is privately held however firms—Procter and Gamble Hygiene and fitness Care Ltd that sells Whisper sanitary napkins and Vicks bloodless and cough products, and Gillette India Ltd that sells shaving, oral care merchandise and batteries—are indexed.

Procter and Gamble Co.’s (P&G’s) control instructed buyers, after their March sector earnings, that they have got determined to go out or repair unprofitable product strains in India. The portfolio they may betargeted on is developing inside the high single digits although overall increase is affected by the restructuring. A massive part of P&G’s India commercial enterprise is privately held but companies—Procter and Gamble Hygiene and health Care Ltd that sells Whisper sanitary napkins and Vicks cold and cough products, and Gillette India Ltd that sells shaving, oral care products and batteries—are listed. Ahuge percentage of restructuring appears to be underway in the unlisted element—website hostingdetergents, shampoos and different private care products.

Their March zone performances deliver some concept on in which the organizations stand on thisrestructuring system. Gillette India’s Duracell battery enterprise has been bought with impact from 19 February, as a part of a worldwide exit from batteries. This commercial enterprise contributed to 7% ofsales in the March region and to fifteen% of income before tax. it’s going to not replicate in Gillette’s financials from the June area onwards.

What remains is the shaving products and oral care enterprise. Shaving merchandise’ income rose by means of a clever 15% from a yr ago and its earnings, too, jumped by using 33.4%. This businesscontributed to nearly three-fourth of sales. In oral care, a “portfolio optimization” exercise caused a nine% decline in income over a year ago, and phase earnings got here in at Rs.14.1 crore, higher compared with the yr–ago quarter’s Rs.17.6 crore loss, but decrease than the December area’s Rs.19.eight croreearnings.

Gillette has benefited from decrease commodity costs, as seen by using a 2.four% decline in cloth prices,even though universal income rose 12% to Rs.553 crore. A yr in the past, its advertising and promotionfees had risen sharply due to its efforts to grow its oral care commercial enterprise. since that has abated and input charges are decrease, its working income has risen from Rs.34.eight crore a year in the past to Rs.123.9 crore. What’s extra, even sequentially, its working profit margin has improved, with the aid ofabout four.five percent factors.

P&G Hygiene’s sanitary napkins and bloodless and cough products are pretty properly–established andprofitable. No fundamental restructuring is likely right here, and its press statement does now not point out something both. in contrast to Gillette, this P&G subsidiary does not break up reporting for the twoproduct segments.

normal, its income rose by 10.5% to Rs.613.8 crore over a yr in the past; but here again, decrease inputcharges supposed that its material costs rose through handiest three%. but, P&G Hygiene’s marketingand income merchandising (A&SP) costs and other expenses have risen notably, up by 40% and 27.three%, respectively. Its royalty fees, too, have risen beforehand of sales growth, up via 17.four%.

There will be an element of timing right here—advertising campaign fees can be incurred in 1 / 4 even though the campaign itself might also run for an extended period. In fact, A&SP expenses are flat in thenine-month length. but, this boom in costs has brought about a pretty muted eight.5% growth in itsworking profit.

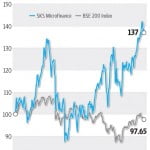

The marketplace’s response to P&G Hygiene’s results showed its unhappiness as its proportion declinedby way of three.2%. but, the improvement in gross margins approach its commercial enterprise is indesirable form and if advertising costs come down to more ordinary degrees within the next quarters, its performance ought to improve. In Gillette’s case, its shares are up by four.2% after its effects. tradersmay be looking to its oral care commercial enterprise to see while growth recovers.