The Cairn India stock has taken a beating due to the really subdued crude oil price environment and has under-performed the benchmark Sensex and the oil and gas index in the past one year. Photo: Bloomberg

It has been a rough ride for oil producing companies, as tumbling crude oil prices have eaten into their profit margins. Cairn India Ltd’s September quarter consolidated net profit declined by 70% to Rs.673 crore compared with the same period last year. Profits were lower sequentially too. But investors may not be surprised; this decline was expected.

In fact, Cairn India’s September quarter profit was marginally above the consensus estimate compiled by Bloomberg. However, that was made possible due to some one-off factors. Firstly, Cairn India earned a tax reversal during the September quarter. Secondly, favourable foreign currency movements resulted in a forex gain worth Rs.381 crore.

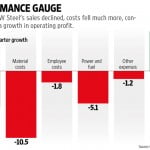

At the operating profit level, Cairn India’s earnings were Rs.911 crore, two-thirds lower than last year’s quarter, and 29% lower than the June quarter. On this measure, the company has actually missed the Street expectations.

Lower crude oil prices affected realizations, in turn adversely impacting revenue growth. Cairn India’s revenue declined 15% sequentially to Rs.2,242 crore. Average price realizations dropped to $43.7 per barrel of oil equivalent representing 22% decrease sequentially. That also reflects an increase in the discount to the Brent benchmark for crude from Cairn India’s Rajasthan block, to 14.3% from 9.9% on sequential basis. This was due to lower demand for heavy crude. Oversupply of heavy crude also suppressed prices, said the company. Lower revenue meant that cess on crude oil, which is one of Cairn India’s major cost components, increased as a percentage of revenue. Operating profit margin thus dropped to 40.6%.

The Cairn India stock has taken a beating due to the really subdued crude oil price environment. It has under-performed the benchmark Sensex and the S&P BSE Oil and Gas index in the past one year. The stock trades at a rather undemanding valuation of eight times estimated earnings for the next fiscal year. But that means little as, unfortunately, few positive triggers exist.

Crude oil prices are not expected to recover in a hurry. Unfavourable demand-supply dynamics (excess supply in global oil markets) are expected to weigh on crude oil prices. Therefore, realizations are likely to remain under pressure.

It augurs well that the company has maintained its production guidance. It has said that it will, at a minimum, maintain Rajasthan production in FY16 at the previous year’s level. For the half-year ended September, gross production from the Rajasthan block declined 2% compared with the last year. Investors would do well to watch out how things pan out on this front. Developments on the Cairn-Vedanta Ltd merger scheme would be an important development to track as well.

Meanwhile, a recent report in the Economic Times said the Rajasthan government has rejected Cairn India’s plea to renew the Rajasthan block’s contract post-2020 with the existing terms and conditions. The government has asked for the investment plan for the renewal period, to assess the extent to which the state’s share of profit can be raised. A lower share for Cairn, if this happens, may not go down well with investors.

[“source -livemint”]