ACC’s legacy cement plants are weighing it down by adding to costs. Photo: Bloomberg

It’s a tough call whether or not to expand capacity in an industry which suffers from over-capacity. ACC Ltd has chosen not to and that is proving to be costly for the firm.

The firm has lost market share in recent times. According to a note from Motilal Oswal Financial Services Ltd, it has limited headroom in north and central India as it is nearing maximum capacity utilization levels and there is no expansion capacity visible in the north. On other hand, in the south and west of the country—where it has enough capacity—demand is weak. Now, the only respite will come from the 2.5 million tonne (mt) expansion in the east.

Analysts expect cement volumes to fall over 2% for the current year. Cement volumes dropped 10% sequentially to 5.61 mt in the quarter ended September. They were also down marginally when compared with a year ago. Year-to-date, cement dispatches have fallen around 4%.

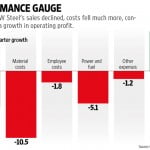

Weak cement volumes also showed up in the September quarter financial results. Net sales were marginally down by 0.1% for the third consecutive quarter. That compares with 4.5% growth seen in rival UltraTech Cement Ltd.

ACC’s legacy cement plants are weighing it down by adding to costs. Operating costs increased by around 2% compared with a year ago.

Also, ACC continues to use linkage coal which is slightly more expensive compared with pet coke. “Even on a variable cost basis, ACC’s power and fuel costs per tonne only declined marginally on a year-on-year (y-o-y) basis, while its freight costs per tonne inched up by about 3% year-on-year amid softening coal/diesel prices. Going forward, on the cost front, we believe ACC will be at a disadvantage (versus its peers) as the auctioning of coal linkages will affect ACC the most (it has the highest domestic coal linkage),” said Nomura Global Markets Research.

As a result, the firm’s operating profits per tonne fell 14% y-o-y to Rs.470 as realizations declined around 2%. Overall net profit declined 40% from a year ago. Shares of ACC have under-performed other large cement makers in the past six months; they are down 8% compared with 5% gains for UltraTech Cement.

That is likely to continue despite the stock trading at cheap valuations of around 13x EV/Ebitda (enterprise value to earnings before interest, taxes, depreciation and amortization multiple) for the next calendar year because of a weak profit outlook.

[“source -livemint”]