Facebook Inc’s stunning $19 billion bid for fast-growing mobile-messaging startup WhatsApp sent shares of BlackBerry Ltd surging after the closing bell on Wednesday, as investors were cheered by the lofty valuation for the messaging platform.

The deal sent shares in BlackBerry up as much as 9 percent in trading after the bell because it put a rough valuation metric around the smartphone maker’s own BlackBerry Messaging service.

BlackBerry Messaging, or BBM as it is more commonly known, was a pioneering mobile-messaging service, but its user base has failed to keep pace with that of WhatsApp, in part because BlackBerry had long refused to open the service to users on other platforms.

WhatsApp, with a user base of some 450 million, has grown rapidly. Its service works on Apple Inc’s iOSplatform, Google Inc’s market-dominating Android operating system, along with devices powered by both the Windows and BlackBerry operating systems.

BBM remains popular, even though BlackBerry devices have waned in popularity. Late last year, the Waterloo, Ontario-based smartphone maker finally opened the messaging platform to users of iPhonesand Android devices, and the service currently has over 80 million active users.

(Also see: Facebook to buy WhatsApp in a $19 billion deal)

However, investors have attributed little value to the asset within the company. On Tuesday, Raymond James analyst Steven Li, in a note to clients, broke out a sum-of-parts valuation of the company and pegged the value of BBM at merely $240 million, or $3 per user.

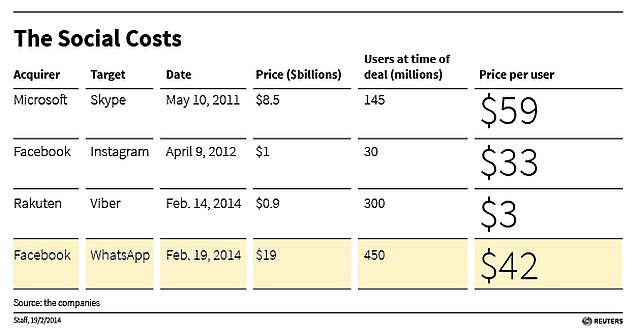

Facebook’s valuation of WhatsApp translates into roughly $42 per user, and that could lead investors and analysts to rethink their valuation of the asset within BlackBerry.

BlackBerry has given no indication it is keen to sell the asset. While there has been some speculation that BlackBerry may seek to carve out the unit, or even sell it, the company’s new Chief Executive John Chen has so far said that BBM remains a core asset for the company.

BlackBerry has given no indication it is keen to sell the asset. While there has been some speculation that BlackBerry may seek to carve out the unit, or even sell it, the company’s new Chief Executive John Chen has so far said that BBM remains a core asset for the company.

After surging as high as $9.82 in post-market trading on the Nasdaq soon after the WhatsApp deal was announced, shares in BlackBerry settled at around $9.54, almost 6 percent above their closing price of $9.01 a share.

© Thomson Reuters 2014

Share a screenshot and win Samsung smartphones worth Rs. 90,000 by participating in the #BrowseFaster contest.

[“Source-Gadgets”]