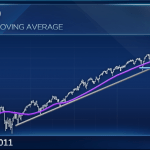

Stocks had their best week of the year and the upswing could continue into Thanksgiving week, usually a good one for the market.

The S&P 500 finished Friday up 3.3 percent at 2,089, its best weekly performance since last December, after logging a 3.6 percent decline the previous week. The Dow rose 3.4 percent, its best week in six.

“People are confounded when the market sells off in August and September and rallies in October. Seasonal patterns tend to be very real and this year’s proving no exception,” said Julian Emanuel, equity and derivatives strategist at UBS.

“I think the market is comfortable with a resolution of uncertainty. Even if it has potentially negative implications, it’s not always a bad thing. People are comfortable with the Fed going to hike in December, and moreover the market is trading this way as if that hike was going to act as an affirmative signal.”

The past week was important in that markets were able to absorb more evidence from the Fed meeting minutes that the central bank plans to raise interest rates in December, unless the economy turns down. The yield on the two-year Treasury, sensitive to Fed policy, rose above 0.9 percent Friday, a more than five-year high.

Strategists had started the week expecting more selling after the coordinated terror attacks in Paris that killed scores. But equities proved resilient and the anticipated flight-to-safety trade did not materialize.

Stocks usually gain in the week of Thanksgiving, and many analysts expect the market to continue higher — even into year-end, though its course could be choppy at times. According to analytics service Kensho, the S&P 500, in the last 10 years, has averaged a gain of 1.9 percent in that week and was positive six times. One possible negative for the week ahead could be further selling in oil, which dipped below $40 several times in the past week.

“The thing with December — because the Fed is there smack in the middle of December — it’s hard to say whether it’s going to be front-loaded or back-loaded,” said Emanuel. “We feel like you could rally straight through the employment report, then take a breather and in all likelihood, Santa will appear and then you rally into year-end.”

[“source -cncb”]