Photographer: Chris Ratcliffe – Pool/Getty Images

Economic forces and incentives shape not only our lives, but also our fiction – and economists rarely miss a chance to point this out. “Economics spotting” isn’t just a parlor game, however. It can help us remember why we care about economics in the first place.

In an era when finance can look like alchemy or worse, its appearance in fiction can remind us that its most fundamental ideas are elegant and essential. There’s a bonus, too: approaching finance this way has the potential to enrich finance itself.

“The Wisdom of Finance,” a new book by my Harvard Business School colleague and mentor Mihir A. Desai, traces financial ideas as they turn up in literature (as well as in music, film and theater). Desai’s panorama underscores how finance serves basic human needs – and crops up in unusual places.

Desai starts with one of the fields of finance often considered to be the driest: insurance. He writes that he’s “delighted and surprised” when his students choose to go into insurance. Why? Because insurance addresses the fundamental uncertainty of our lives – the type personified in the life of Flitcraft, a fictional real estate executive described in “The Maltese Falcon.”

Flitcraft narrowly avoids death when a falling beam crashes into a sidewalk as he walks by. This random scare sends him in search of a random existence; he changes his name to Charles Pierce and lets his life take loops and unexpected turns. 1 By exposing himself to risk, Flitcraft becomes a human embodiment of the need for insurance. (This was intentional. Flitcraft is named after an early actuary; the mathematician and philosopher Charles Peirce 2 was an early champion of insurance.)

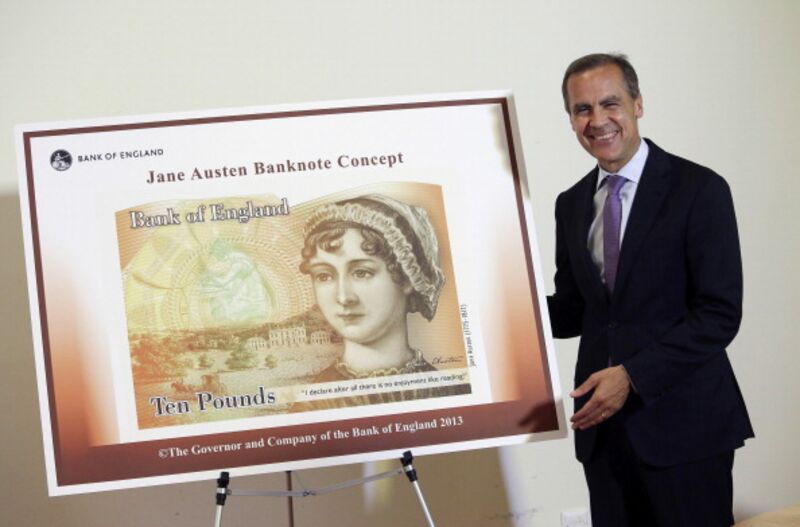

Desai also uncovers finance theory in Victorian romances. In Anthony Trollope’s “Phineas Finn,” Violet Effingham thinks about option value as she maintains a diversified portfolio of suitors. Lizzy Bennett, Jane Austen’s heroine of “Pride and Prejudice,” faces a classic “optimal stopping problem,” in which she risks ending up alone after turning down her first suitor. (Spoiler alert: Bennett’s bet pays off – she ends up with the delightful Mr. Darcy.)

While I’ve focused on literary examples, Desai’s exposition runs the cultural gamut. Jeff Koons manifests leverage in his art by financing and promising to create pieces before he knows how to construct them. Bialystock and Bloom’s antic scam in “The Producers” reminds us how important it is to have investor oversight.

At the end, Desai gives us a finance heroine to admire: Alexandra Bergson of Willa Cather’s “O Pioneers!,” who takes calculated risks in land investment for the benefit of her loved ones – and even in success thinks of herself as only a steward of capital.

So where does this journey lead? First, it gives a vibrant rediscovery of finance a human face. That alone is valuable, especially for those disheartened by the financial crisis, rising inequality and finance bros. But Desai’s “Wisdom” does more; it reminds us what’s meaningful in finance, both in terms of theory and in terms of the people that theory supports.

If finance were better attuned to its human impact, we might see fewer Martin Shkrelis and more Alexandra Bergsons. At a more macro scale, we might see more research, business and policy that recognizes the consequences of modern finance’s faults. There’s a lesson for the rest of economics here, too: As we bring economics to bear on human problems like intergenerational mobility, immigration and housing, it might pay to be well-read.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

[“Source-ndtv”]