instead of growing, entrepreneurial activity has reduced in size in the course of the current monetaryrecovery. Bureau of exertions facts estimates display that the range of included self-hired – theauthorities’s most contemporary measure of the stock of entrepreneurs in the economy – turned intofour percentage lower in September 2014 than it become in June 2009, while measured as a fraction of the (non-navy, non-institutional) populace.

The decline is simple in contrast to the 10 percent drop inside the in keeping with capita charge ofintegrated self-employment in the course of the super Recession. but that discount isn’t surprising.economic slowdowns reason a number of humans’s entrepreneurial efforts to fail and deter many would-be marketers from setting up store.

however, now that we are more than five years into the modern economic growth, we need to havevisible a healing in entrepreneurial hobby. when the economy starts offevolved to grow once more after a downturn, sales at already present corporations ought to growth, inflicting their earnings to upward push. As a result, fewer of those organizations should go under than whilst the financial system is contracting. on the equal time, could-be marketers must be attracted by using the rising sales at presentgroups and emerge as much more likely to set up save. collectively a declining go out charge and agrowing access rate need to growth the variety of human beings walking their very own agencies.

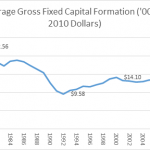

The fee of entrepreneurship appears to have stopped declining in mid-2010, as the figure above indicates.but we haven’t yet visible an upward fashion inside the according to capita rate of incorporated self-employment. (The dotted line within the graph suggests the six month moving average within themeasure, which become used to smooth out the noise in the monthly estimates.)

facts from the Gallup/Wells Fargo Small enterprise Index suggest that sales, income, and cash waft at small organizations have all risen because the start of the monetary recuperation. in the 0.33 zone of this12 months, 43 percent of small business owners instructed the surveyors that their corporation salesexpanded over the last 365 days, up from 24 percent in the 2nd sector of 2009. Fifty-5 percentpronounced that their cash float changed into proper or very good in the 1/3 sector of this 12 months,as opposed to handiest forty four percent in the 2d sector of 2009. And sixty two percent stated theircommercial enterprise’s financial situation became correct or excellent, in comparison with most effective 55 percent within the 2nd area of 2009.

Figures from the national Federation of independent business (NFIB) verify this positive fashion. Thenet percentage of NFIB individuals reporting better earnings over the preceding three months – the fraction saying that their income were higher less the element announcing their profits have been lower– stepped forward from –42 in June 2009 to -19 in September 2014. And the internet percentage reportinghigher income over the preceding 3 months progressed from -34 at the beginning of the restoration to –four in September 20014.

If small commercial enterprise owners are reporting that their agencies’ income, profits, cash float, andmonetary situations are all higher than they had been on the begin of the monetary restoration, then theprice of entrepreneurship ought to be increasing. higher monetary situations ought to have reduced therange of people giving up on their entrepreneurial efforts and inspired greater might-be businessproprietors to take the plunge.

Why do you watched the monetary expansion hasn’t brought about a restoration in entrepreneurialinterest?