Petrol and diesel consumption grew by about 15% year-on-year in October, according to a report. Photo: Ramesh Pathania/Mint

The average price of the Indian crude oil basket has fallen further. An analysis of Petroleum Planning and Analysis Cell data shows that pricing for the first fortnight this month is among the lowest since April 2011. The price of the Indian crude oil basket has dropped to Rs.2,639.71 a barrel on 16 November or Rs.16.6 per litre. That’s the lowest this month.

This means since the diesel deregulation in 2014, the price of the Indian basket of crude oil in rupee terms has halved. However, retail product prices haven’t fallen at the same rate. For perspective: retail prices in Delhi for diesel declined at a much slower pace of 24% while those of petrol have fallen even more gradually by 9% on a relatively high base.

The reasons for this trend are not unknown. For one, the tax component (as a result of excise duty hikes, value-added tax, etc.) as a percentage of retail prices has increased for both petrol and diesel. Secondly, while the Indian crude oil basket is indicative of broader trends, the decline in specific product prices and related crack movements become a key factor when understanding product price movements.

This column has pointed out earlier that Indian consumers haven’t benefited fully as the government chose to retain a portion of the benefits of falling crude oil prices instead of passing it on to the consumers.

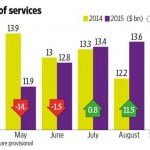

Nevertheless, lower prices seem to be an important element in boosting diesel and petrol consumption in recent months. Petrol and diesel consumption grew by about 15% year-on-year in October, wrote Jefferies Equity Research in a report on 16 November. This comes on the back of over 20% growth in September. There is a sharp spike in diesel consumption growth so far this year after two rather dull years, while petrol consumption growth for FY16 so far has been the highest since FY2003.

According to Jefferies Equity Research, in the case of petrol where there has been a distinct acceleration in growth since 2H FY15, lower prices are most likely a key factor driving stronger growth. Lower dieselization of passenger vehicles is the other major reason, adds the brokerage firm.

For diesel, while lower prices may have helped to some extent, recent consumption growth could well be due to seasonal factors, given that consumption growth moved up to 3.3% in FY16 till August versus 1.5% in FY15. As Jefferies highlights, “the unusually sharp acceleration (in diesel) over the last two months suggests that there may be other factors at play such as greater use in agriculture and power generation due to poor monsoon”.

[“source -livemint”]