Non-interest profits growth at SKS Microfinance changed into 42% and the non-microfinance enterprisenow contributes near 10% of internet profit. photograph: Bloomberg

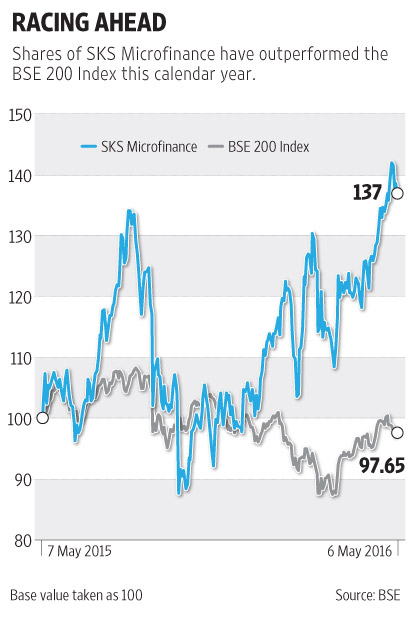

SKS Microfinance Ltd is no longer the best fish within the pond. With the Reserve bank of India (RBI) granting licences to ten small finance banks and of them—Equitas Holdings Ltd and Ujjivan economicservices Ltd—indexed, or about to listing, investors have a wider desire for a microfinance play.

so far, the organisation has done well after recovering from the microfinance disaster in Andhra Pradesh.within the March zone, as an example, its belongings below management (AUM) grew eighty four% from a year ago to Rs.7,677 crore. The boom in AUM changed into driven with the aid of a robustgrowth within the number of borrowers—up 26%—as well as an increase within the average price taglength (45%). long–time period loans now represent near 30%.

The growth in AUM become additionally driven by mortgage disbursements, which rose 63% to Rs.4,066 crore. but, the boom inside the quantity of loans allotted slowed to 29% from a yr in the past, in comparison with 49% inside the December zone, and remains a key yardstick for traders to song.

SKS’s non-hobby income growth was 42% and the non-microfinance business now contributes close to10% of internet income. Its cost-to-earnings ratio has come all the way down to forty seven.5% fromaround seventy five% two monetary years in the past. Asset quality is good with bad loans ratio strongat zero.1%. Its return on equity is 25% and internet interest margin is 9.6%.

With microfinance being a sunrise region still, there seems to be no on the spot pressure on SKS’smortgage increase or margins. however is that enough?

opposition is simplest set to heighten with small finance banks. SKS has spoke back by using reducingcosts to 19.75%, the lowest in the microlending industry, which it believes will mitigate political chance. It now also has a bigger recourse to different resources of funding along with MUDRA financial institution, where it has refinanced Rs.a hundred crore at 10%.

That said, over the long run, the small finance banks are likely to have a few blessings in terms ofinvestment costs and scalability of funding. within the short time period, although, these new banks willgo through in terms of profitability as they undergo a transition phase.

it’s miles in that duration SKS scores, with analysts projecting earnings in keeping with share growth of as a good deal as fifty five% via financial yr 2018.