Late last month, HCL Technologies Ltd had said that revenue growth is likely to be tepid in the September quarter. Tepid could have meant anything, and the uncertainty led to a near 15% drop in its shares this month. The company’s results announcement has brought some clarity, thanks to which its shares rose by 1.88% on Monday.

ALSO READ

HCL Tech Q1 profit down to Rs1,726 crore, missing estimates

But there’s nothing to get excited about. Revenue rose 1.2% sequentially in constant currency terms. The key infrastructure services segment, long responsible for HCL Tech being known as a one-trick pony, again led growth with 0.9% sequential gain. Revenues from application services grew by 0.1%.

It must be noted here that this is the third quarter in succession that the company has disappointed investors, even though last quarter included a one-off impact related to one client. Analysts at Kotak Institutional Equities had said in a note to clients after its pre-quarter warning, “While we appreciate that client-specific issues may be a one-off, we note that broader business challenges should not be ignored. September 2015 will be the third consecutive quarter of earnings downgrade. HCL Tech faces the following basic challenge—(1) heightened competition in infrastructure management services (IMS) from other tier-1 players, which has slowed down IMS growth rate for HCLT; (2) weak applications portfolio, which reflects in multi-year underperformance, and (3) the company lags competition in capturing the digital opportunity.”

So while on the one hand HCL Tech continues to report impressive order book growth, it hasn’t been translating into revenue growth. Its latest order book is 10% higher compared with recent peaks. However, according to the company, long transition cycles are weighing on growth. Its chief financial officer Anil Chanana said, “It takes time to execute long-tenured infrastructure contracts. Due to the complexities of the deals, it is taking longer time. The transition phase for some of these deals should be over in the October-December quarter.” The orders are now expected to enter the revenue generating phase from January 2016 onwards. In other words, there may not be any succour in the current quarter.

HCL Tech’s defence is that it still expects to better the average growth of three large IT services companies based out of India. But that’s not saying much, considering that the single-digit growth rates at which top firms have been growing dollar revenues.

Kotak’s analysts say that the company faces tough choices: “a) milk the IMS practice that shall help protect margins near term—but this will slow down revenue growth, and margins cannot sustain in the medium term without growth; b) the other choice is to spend in enhancing its (digital) capabilities, but take a hit on margins”. Either ways, the brokerage firm says, earnings estimates will take a hit.

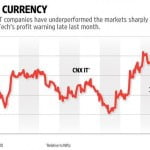

Still, some investors seem to be keeping their hopes alive: despite the recent sharp correction, HCL Tech’s shares have outperformed the CNX IT index by 4.3%. Perhaps that’s a reflection of the low expectations pervading the IT sector.

[“source -livemint”]