Net profit fell by around 4% year-on-year to Rs.394 crore, disappointing the Street as it lower than Bloomberg’s consensus of Rs.432.5 crore. Photo: Pradeep Gaur/Mint

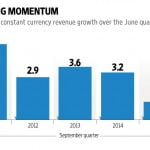

In the absence of capex revival and with the monsoon season overhang, the Street expected frugal revenue and profit growth for cement firms in the September quarter (Q2). Pan-India cement maker UltraTech Cement Ltd’s performance was in line with the forecast.

The highlight was a robust 17% operating margin, which was a tad higher than a year back but in line with Bloomberg’s consensus. Much of this came from lower costs. The biggest relief came from power and fuel expenses, which fell by nearly 125 basis points (bps) on a per tonne basis. A basis point is 0.01%. Higher use of petcoke, whose price was almost 14% lower than a year back, aided this. Freight costs too fell a bit during the quarter.

Unfortunately, these gains were offset partially by the higher raw material cost, thanks to the mandatory contribution to the Direct Mineral Fund (DMF). Of course, realization per tonne of cement sold too was flat year-on-year (y-o-y), though marginally higher from the June quarter. Net revenue for the stand-alone entity was about 4.5% higher than the year-ago period, driven mainly by higher sales volume. Adjusting for DMF, operating profit was 12% higher y-o-y.

How did UltraTech Cement manage this given the weak environment? The management attributes this to higher penetration in rural markets during the quarter.

Net profit fell by around 4% y-o-y to Rs.394 crore, disappointing the Street as it lower than Bloomberg’s consensus of Rs.432.5 crore. This was partly due to lower other income and higher depreciation, which was on account of revision in the life of its assets. Not surprisingly, UltraTech Cement’s shares fell by 1.76% to Rs.2,903 on a day when markets closed higher than in the previous day.

That said, note that in spite of the travails of the cement sector, UltraTech Cement has scored on operating performance. Even with subdued cement prices and weak realization, the firm has held out profit margins. Further, its sound finanical health with an interest coverage ratio of 6.1, in spite of acquisitions and expansions, makes it a preferred pan-India cement firm on the bourse.

Mark to Market writers do not have positions in the companies they have discussed.

[“source -livemint”]