The energy/power sector, which accounts for four-fifths of its order book and about 75% of its sales, is in the throes of poor capacity utilization. Photo: Mint

Shares of Thermax Ltd have declined 4.8% since its earnings were declared three weeks ago. That’s better than the performance of the BSE Capital Goods index, which has shed 8.2%. But the outlook for the company, as for other capital goods makers, is quite dim in the medium term.

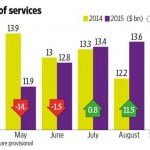

In the September quarter, Thermax’s consolidated order inflows fell by one-fifth from a year ago. In the stand-alone book, order intake from the energy business was down by one-fifth while the environment business saw a sharper decline of 34%.

Moreover, its outstanding order book also fell by one-fourth to Rs.5,162 crore. That reduces sales visibility as well with the order book to estimated sales (for the next four quarters) ratio at 0.9. This is not counting the danger of clients asking capital goods makers to go slow as they struggle to boost demand and earnings.

Things are not going to get better in a hurry, something the management told analysts in a post-earnings conference call. The energy/power sector, which accounts for four-fifths of its order book and about 75% of its sales, is in the throes of poor capacity utilization. In April-September this year, plant load factor for thermal power plants was a poor 61%, a five-year low. The thermal power sector is unlikely to see a government push—as is happening in some other industries such as roads—because of the thrust on renewables.

The captive power sector is also unlikely to drive growth. Metals, one of the key client industries in this area, is feeling the brunt of the commodity price meltdown. Cement, too, is unlikely to generate demand with trailing 12-month capacity utilization at 70%.

To be sure, Thermax has increased its focus on the export markets. Export orders in its stand-alone order book grew 28% from a year ago compared with a 35% decline in domestic intake, according to IIFL Institutional Equities. However, there is a big question of sustainability. With a dim global growth outlook, there is increasing competitive pressure and the risk of falling prices.

Then again, the international business will take some time to scale up. While the firm’s base products business—which generates about 40% of sales and caters to industries such as food processing and pharma—will yield some relief, the company’s prospects won’t look up till the big ticket energy sector orders flow in. That looks at least a year away.

[“source -livemint”]