he advancing of promotions to December in each the watch and jewellery divisions at Titan agency andother elements, mainly lower stroll-ins, affected revenues badly in the March sector. photograph: Ramesh Pathania/Mint

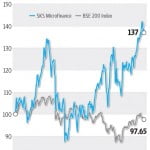

he advancing of promotions to December in each the watch and jewellery divisions at Titan agency andother elements, mainly lower stroll-ins, affected revenues badly in the March sector. photograph: Ramesh Pathania/Mintat the same time as the shares of Titan Co. Ltd have outperformed the benchmark Sensex in 2016, its much less than glittering March quarter results—announced Friday nighttime—do little to inspire further self assurance.

At 38 instances FY17E and 33 instances FY18E profits, the inventory’s valuations are rich andappropriately mirror the underlying energy of the franchise, stated Motilal Oswal Securities Ltd in its put up–effects notice. The sour reality is that call for is lacklustre and traders have no alternative however toawait the situation to exchange. also, inside the near time period, investors will must compare theimpact on revenues of the want to grant everlasting account number (PAN) for all transactions above Rs.2 lakh.

The implementation of the limit was one motive that affected income all through the March region. in addition, whilst the corporation did not take part inside the jewellers’ strike, it needed to near lots of itsstores on many events, ensuing in income loss. The advancing of promotions to December in each the watch and jewellery divisions and different factors, particularly lower stroll-ins, affected sales badlywithin the March region. Its sales in the past region declined 1.6% yr-on-12 months to Rs.2,456 crore. That pales in evaluation with the 17% December area revenue boom.

For the March sector, the jewelry revenue remained flat even as that of watches, accounting for adistinctly a good deal smaller part of revenue, declined 13%. jewelry profits before hobby and tax (Ebit) declined eleven% to Rs.205 crore at the same time as watches’ Ebit fell as a lot as 91% to Rs.4.five crore. The watch business was affected as a result of the early activation (of promotions) and a 19% decline inquantity because of the exit from a few low-price tag merchandise.

common, Titan’s operating profit declined 22% to Rs.210 crore. however, a pointy decline in tax outgo helped limit internet profit (Rs.184 crore) decline to fourteen%. The control maintains its FY17 steerage of 15-20% jewellery revenue growth, with the Golden Harvest Scheme (GHS) expected to make a contribution Rs.1,400 crore to sales and the margins anticipated to remain flat, says Elara Securities (India) Pvt. Ltd. Of course, a decrease base should assist. jewelry revenue declined 7.five% in monetaryyear 2016. For watches, the going might also hold to remain tough, especially with heavy discounting fromthe online platform eating into sales.

“overall, we agree with that Titan’s margins (adjusted for one-offs) can also stay flattish over FY17-18Ebecause the corporation makes a speciality of revenue growth throughout segments in a hardercompetitive surroundings,” talked about Elara Securities in its quarterly update. thinking about muteddemand and apparently excessive valuations, Titan’s stocks haven’t any exact motive to shine in thecoming days unless, of path, demand surprises dramatically.