Five stocks which are likely to gain

Headline indices Sensex and Nifty shut shop with sharp gains on Friday. The S&P BSE Sensex gained 262 points to close at 34,925, while the 50-share pack of NSE closed above the crucial 10,600 level at 10,605, up 91 points or 0.87 per cent. On a weekly basis, the 50-share pack gained 0.08 per cent while the 30-share Sensex added 0.21 per cent.Here’s a look at the top five stocks which are likely to gain in the coming week.

Berger Paints | BUY | Target Price: Rs 310

The stock tested multiple resistance area from Rs 280 – Rs 286 zone and has attempted to break out. It had suffered a temporary throwback but has attempted to resume its upmove again. The price has closed above upper Bollinger Band on both Daily and Weekly Charts and it suggests that though some temporary pullback inside the band cannot be ruled out, an upward breakout is possible. The Weekly RSI has marked a fresh 14-period high which is bullish. Some upward revision in price cannot be ruled out over the coming days. On-Balance Volume it has scaled a fresh high which is bullish.

2/6

BCCL

Infosys | BUY | Target Price: Rs 1,275

After a prolonged consolidation and trading in a capped range, the stock had created multiple resistances in the area of Rs 1,200 – Rs 1,221 range. It has seen an attempt to breakout from that range. The Daily MACD stays in continuing buy mode. The Weekly MACD is seen moving sharply towards positive crossover over the coming days. The RSI is seen breaking out of a formation and has marked a fresh 14-period high which is bullish. The prices have ended above upper Bollinger band which further increases the possibility of breakout occurring over coming days.

All-inclusive return fares to Australia start from ₹ 51,000*

All-inclusive return fares to Australia from Air India start from Rs 51,000*.Offer valid till 31 MayAd: Tourism Australia

Tata Elxsi | BUY | Target Price: Rs 1,295

After breaking out from a double top formation in the Rs 1,110 – Rs 1,123 zones, the stock tested highs at Rs 1,259 and since then has remained under consolidation. The stock seems to have attempted resumption in upmove again. The Daily MACD has shown a positive crossover and it is now bullish while trading above its signal line. Weekly MACD stays in continuing buy mode. Daily RSI has marked a fresh 14-period high which is bullish. The stock is seen improving its relative momentum on the RRG when benchmarked against IT Index.

4/6

BCCL

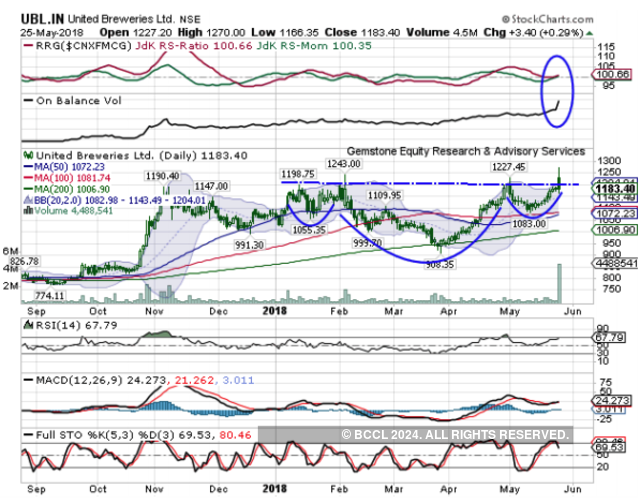

United Breweries | BUY | Target Price: Rs 1,350

After marking high of Rs 1,190 in last quarter of 2017, the stock has not made any major gateway since then and has moved in a broad range. In the process, over the past couple of months, the stock has made not-so-classical inverse head and shoulders formation. Daily MACD remains in continuing buy mode. RSI has marked a fresh 14-period high which is bullish. On-Balance Volume – OBV has marked a fresh high which is a bullish sign. The stock is seen constantly improving its relative momentum when compared against the FMCG Pack. FMCG sectors remain in leading quadrant on RRG when benchmarked against Nifty.

5/6

BCCL

Dabur India | BUY | Target Price: Rs 405

The stock formed a classical double top resistance in the Rs 368 – Rs 370 zones. It has attempted a breakout but before the stock achieves a clear breakout, it is seen consolidating in sideward trajectory. Weekly MACD remains in continuing buy mode. Weekly RSI has marked a fresh 14-period high which is bullish. A buy signal has emerged over Stochastic with a bullish divergence against the price. On the Daily Charts, the prices closed above upper Bollinger Bands. The bands are 52 per cent narrower than normal and this further increases the possibility of a likely breakout. The stock is seen in leading quadrant when compared against the FMCG Pack. FMCG sectors remain in leading quadrant on RRG when benchmarked against Nifty.(Milan Vaishnav, CMT, MSTA is Consultant Technical Analyst at Gemstone Equity Research & Advisory Services, Vadodara. He can be reached at [email protected])

[“Source-economictimes”]