Not surprisingly, investors who start when they’re younger have a tremendous advantage later on, so how can we help younger people start investing earlier in life?

My firm has been working to share the wealth of knowledge for the past year. We’ve hosted a job shadow day, volunteered at a local school, and encouraged our clients and shareholders to reach out to the young people in their communities.

There is still so much work to be done, and experienced investors have an important role to play.

If you’ve been thinking about how you can help empower others to start investing, here are four approaches that we’ve found really hits home.

1. Tell your story

Personal stories resonate with people. At the job shadow day, students wanted to hear stories about how we started our careers in the investment world. We’ve found that people respond to specific stories of how investing has helped us in our lives.

Real-world examples are often missing from our conversations about money, even with the people we love, and that’s unfortunate because these stories can give younger people a more concrete understanding of how investing can benefit them.

2. Meet people at their level

We hosted an investing night for young women who were just starting out in their careers, and we assumed that we’d talk mostly about fund investing. But we discovered that they were more interested in learning about what kinds of accounts were available to them and how to open an account.

When you’ve been investing for decades, it’s easy to forget how overwhelming it can be just to get started. There are so many decisions to make, so it’s best to focus on helping people take the next step.

If someone has been putting money aside in a savings account, you might talk about how money-market funds often pay higher interest than savings accounts. If someone just opened an IRA, you could talk them through their investment choices.

3. Show the power of compounding

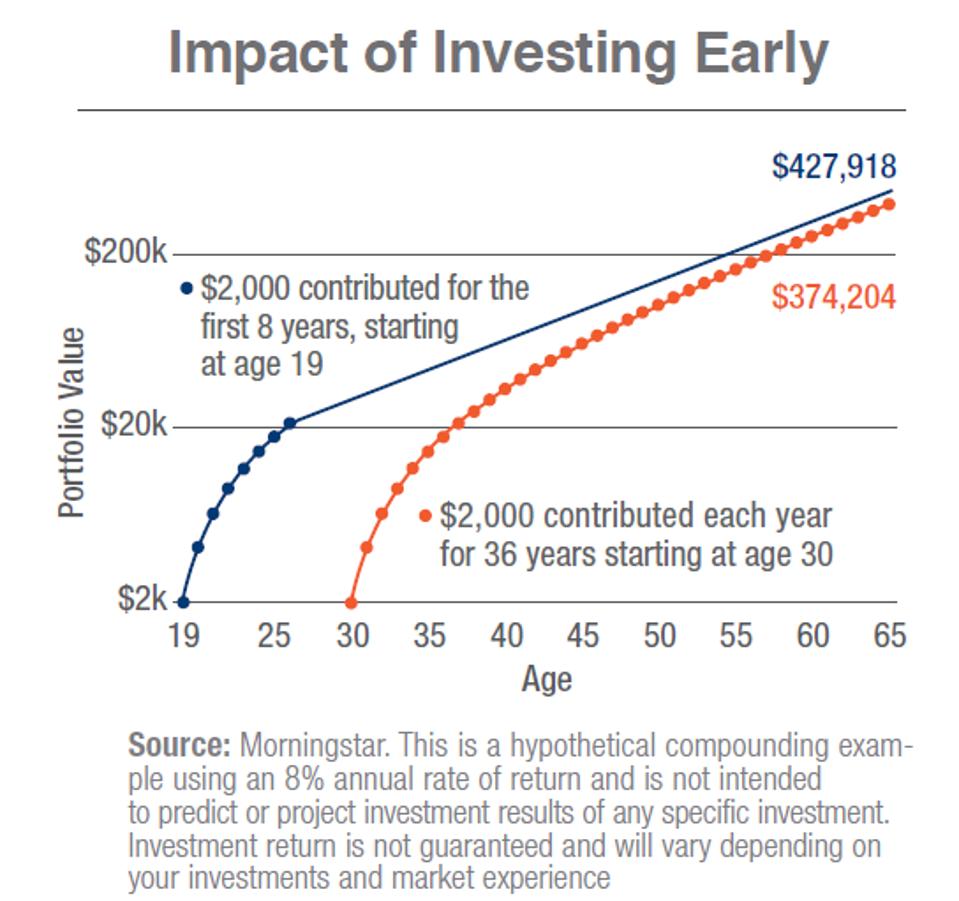

Don’t just tell about how investing early pays off over time, show them how compounding can help them turn time into money. Here’s one of the compounding examples my firm uses. It assumes a constant 8% return for two investors: one who starts early in life and one who starts 11 years later.

Investor #1 (blue line) starts investing $2,000 a year at age 19 through 27. Then she stops adding money to her account and just stays invested until age 65. Investor #2 (orange line), on the other hand, waits until she’s 30 years old to start investing. She diligently invests $2,000 a year for the next 36 years. By age 65, she’s contributed a total of $72,000 to her investments, and yet she ends up with less money than Investor #1 simply because she missed the opportunity to compound gains on 11 years of growth and contributions.

impact of investing early

FUNDX

We shared this example with a high school senior who was doing a senior project on investing, and he was so inspired that he set a goal to invest $2,000 a year in his 20s. He worked out that in order to meet this goal, he’d need to save about $5-$6 per day.

4. Partner with local organizations

Once you’ve talked with the young people in your life about investing, partner with local organizations who can help you reach more people in your community. We teamed up with Junior Achievement, a national organization with a 100-year history of teaching young people about financial literacy and entrepreneurship. Junior Achievement made it easy for us to connect us with local high school students who were thinking about a career in finance and volunteer our time at a nearby elementary school. Click here to find the Junior Achievement location closest to you.

If you’ve been investing for some time now, you know how important it is to take charge of your financial future. Long-term investing can change your life. So pay it forward: reach out to others and help them get the investing education they deserve.

Last month at the Investment Management Education Alliance (IMEA)’s annual Star Awards, we were recognized for our efforts. You can learn more about it in this short video.

[“source=forbes”]