The age of the driver is a factor in determining car insurance premium rates. For example, a married 40-year-old couple will add a teen driver to their policy, and the teen’s rates will reflect that added cost to the parents’ policy. Gender is not a determining factor in premiums in California, Hawaii, Montana, North Carolina, and Vermont. In some states, such as New York, the insurance company does not consider a person’s gender when deciding auto insurance premiums.

Age of Driver:

The age of the driver is also a determining factor in the rate. Younger drivers are likely to have fewer accidents and have higher insurance bills. But if you are older and have multiple cars, your premiums will be lower. You should also keep in mind that women and drivers between the ages of 25 and 65 tend to have lower insurance claims than men. In most states, liability coverage is the only option for car insurance.

However, the age of the driver should not be a deciding factor. Insurers often consider your age to determine your rate. If you are over 21, your rates won’t be affected as much. Those with a clean record are also eligible for many discounts. For example, if you work from home or have lower mileage, you may be able to obtain a lower rate if your employer offers a discount. In addition, cars with advanced safety features and low mileage may be cheaper than those with high-priced features.

Type of Car:

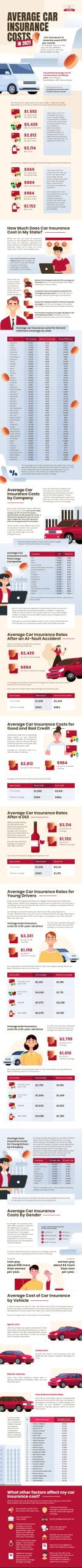

While it is important to get quotes from as many insurance companies as possible, there are several other factors to consider as well. First, the type of car you drive. If you drive a luxury or high-performance vehicle, you will probably need to pay a higher premium than a middle-priced car. Insurers look at the average of similar cars in your state. That way, you can compare the different prices and choose the one that suits you best.

Credit Score:

Secondly, your credit score. If you have a good credit score, you will qualify for the lowest premiums. While your credit score is important, it isn’t the only factor that affects the costs of your car insurance. If you’ve been in an accident or have a clean driving history, you can expect to pay a lower premium. If your driving record is clean, you can get a cheaper car insurance premium.

Your Location:

Next, your location is an important factor. Insurers want to know where you live. If you live in a crowded city, you’re more likely to get into an accident than you do in a rural area. While you can’t change the age of your car, your zip code can influence your rates. Insurers also use your zip code to assess the risk of a driver. The insurance company will use this information to determine your base rate.

Driving History:

Your driving history is another important factor in determining the price of premiums. The more violations or accidents you’ve had, the higher your premiums will be. Likewise, a lower credit score will mean a higher premium. If you’re looking for the cheapest car insurance, you may be surprised to learn that your location can affect your rate. If you’re a new driver, check your state laws and ask a licensed insurance agent to review your records.

Number of Accidents:

The cost of crashes and the number of accidents are important factors in determining the cost of car insurance. The more accidents you have, the more you’ll have to pay. Insurers also consider the gender of the driver. Men are more likely to have an accident, so they’ll have to pay more for male drivers’ insurance than their female counterparts. You can reduce your rates by taking advanced driving courses or driving with an experienced driver.

The average car insurance rate for full coverage is $176 per month. The cheapest is $64 a month. The most expensive is New York, while Wyoming is the most expensive. The rates vary widely by company, but some companies are more affordable than others. For instance, State Farm quotes are cheaper than Nationwide. Depending on your age, you might find that you need to raise your deductible to get the best rate. The amount you pay will depend on your driving history and your state of residence.

Image Source :- https://cartitleloanscalifornia.com/average-insurance-cost/